Cash Pours Into Distressed Real-Estate Funds as Investors Aim to ‘Play Offense’

Investors are putting billions of dollars into new real-estate funds created to buy distressed debt backed by hotels, malls, office buildings, and other commercial properties suffering big losses of value during the coronavirus crisis.

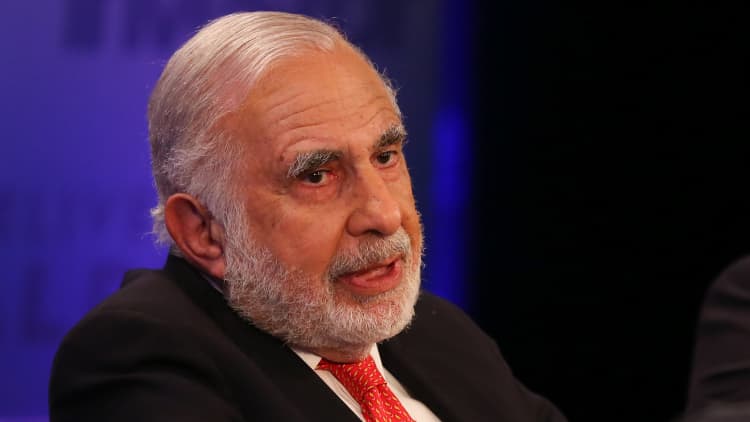

- Billionaire investor Carl Icahn told CNBC he expects the U.S. commercial real estate market will crumble.

- He said he is shorting the commercial mortgage bond market, and it’s his “biggest position by far.”

- He said the housing market bubble of 2008 has “happened all over again.”

Billionaire investor Carl Icahn told CNBC on Friday he expects the U.S. commercial real estate market will crumble, much like the broader housing market collapse of 2008.

“You’re going to have this blow up, too, and nobody’s even looking at it,” Icahn said on “Halftime Report.”

Short selling is a bet against stocks or bonds, with shorts borrowing shares from an investment bank and selling them in hopes that the asset will lose value. If it does drop, shorts buy the shares back at a cheaper price and return them to the bank, turning a profit on the difference.

Icahn’s short is specific to credit default swaps, or “CDS,” which are assets that back mortgages of corporate offices and shopping malls. Icahn said the housing market bubble of 2008 has “happened all over again” due to loans made in 2012 to shopping malls and more.

“You have a bunch of mortgages ... so the banks went out and loaned money against a lot of shopping malls, office buildings, hotels and retail,” Icahn said. “It’s all credible institutions doing it again.”

The banks sold mortgages on commercial real estate “and then, when they did those mortgages, [the banks] sliced and diced them and put them in something called a ‘CMBX,’ an index,” Icahn said. The banks then sold bonds against these mortgages to clients. Icahn expects shopping malls and others in commercial real estate will default on these loans.

“A lot of these bonds now are in grave danger,” Icahn said. “It’s like selling insurance to someone who’s going to go to the electric chair in a couple of months.”

Overall, Ican thinks the market’s drop was catalyzed by the coronavirus pandemic and still “has a longer way down.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

What that means for the Church Market is, banks are going to be far more aggressive when it comes to collecting on large church loans whose membership is no longer supporting the church at the same levels as before the Corona Pandemic started.

More foreclosures, more debt selling, and more extremely aggressive collection methods by the banks.